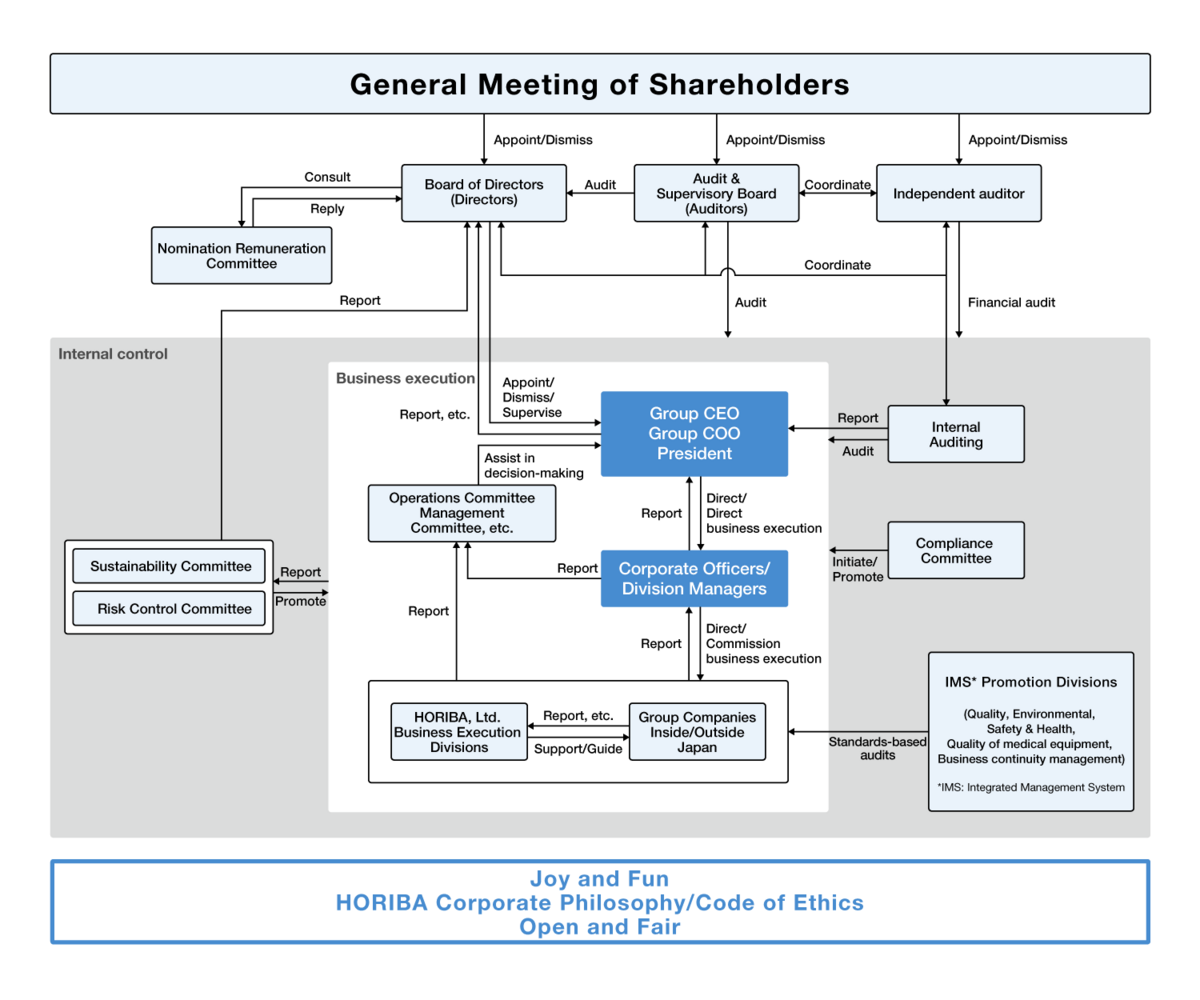

Corporate Governance

Since the time when little attention was paid to corporate governance, HORIBA has pledged to improve its corporate governance by implementing the following policies, which focus on the responsibility to the company's owners based on the corporate motto, "Open and Fair."

Election of External Directors Corporate Auditors

In order to avoid management with introverted logic, HORIBA has always appointed directors and corporate auditors from outside the company. This practice started with the company's origin in 1953 and is followed through to the present day.

Implementation of Dividend Policy that Emphasizes Shareholder Returns

HORIBA refers to shareholders as "owners" and have continued to pay dividends to shareholders based on a payout ratio since 1974, the earliest among listed companies in Japan. In 2013, we had changed from dividend policy targeting at 30% of nonconsolidated net income to the total shareholder return, combined with the amount of dividend payments and share buybacks, targeting at 30% of consolidated net income.

At the Board of Directors meeting held on February 14, 2024, we changed the shareholder return policy as below;

“Targeting a dividend payout ratio at 30% of net income attributable to HORIBA, Ltd., while special dividend and share buybacks will be executed timely and properly, taking into account investment opportunities, cash flow situation and other factors".

Open General Meetings of Shareholders

Since its initial listing in 1972, HORIBA has encouraged all shareholders to attend the General Shareholders Meeting. Shareholder meetings are held on Saturdays to facilitate public attendance.

Adoption of a Corporate Officer System

HORIBA has decreased the number of directors to prevent the Board of Directors from becoming inflexible and avoiding lively discussion. In addition, we introduced a corporate officer system in 1998.